A. Introduction

The Office of the Correctional Investigator was established in 1973 pursuant to Part II of the Inquiries Act. With the proclamation in November 1992 of Part III of the Corrections and Conditional Release Act, this is now its enabling legislation. The mandate of the Correctional Investigator, as defined by this legislation, is to function as an Ombuds for individuals serving a federal sentence. The Correctional Investigator is independent of the Correctional Service of Canada and may initiate an investigation on receipt of a complaint by or on behalf of an individual serving a federal sentence, at the request of the Minister or on the Correctional Investigator’s own initiative. The Correctional Investigator is required by legislation to report annually through the Minister of Public Safety to both Houses of Parliament.

Internal Services supports the delivery of the Office's Ombuds role to individuals serving a federal sentence as well as its corporate obligations to the Central Agencies of Government. This refers to the activities and resources of the ten (10) distinct service categories that support Program delivery in the organization.

This quarterly financial report should be read in conjunction with the Main Estimates (and as applicable - Supplementary Estimates and previous interim reports for the current year). It was prepared by management, using financial data provided by Public Safety Canada as stipulated by a Memorandum of Understanding and as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board of Canada. It has not been subject to an external audit or review.

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the agency's spending authorities granted by Parliament and those used by the organization consistent with the Main Estimates and Supplementary Estimates (as applicable) for the 2024-25 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes. When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The organization uses the full accrual method of accounting to prepare and present its annual financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

B. Highlights of fiscal quarter and fiscal year to date (YTD) results

This section highlights the significant items that contributed to amounts available for use and expenditures used for the quarter.

Risks and Uncertainties:

This Quarterly Financial Report (QFR) reflects the results of the current fiscal year in relation to the Main Estimates (and Supplementary Estimates as applicable).

Approved by:

Ivan Zinger. J.D., Ph.D.

Correctional Investigator

Ottawa, Canada

Shehmina Shamsi.

Chief Financial Officer

Ottawa, Canada

By Vote

| Fiscal Year 2024-25 | ||

| Total available for use for the year ending March 31, 2025 | Used during the quarter ended June 30, 2024 | Year to date used at quarter-end |

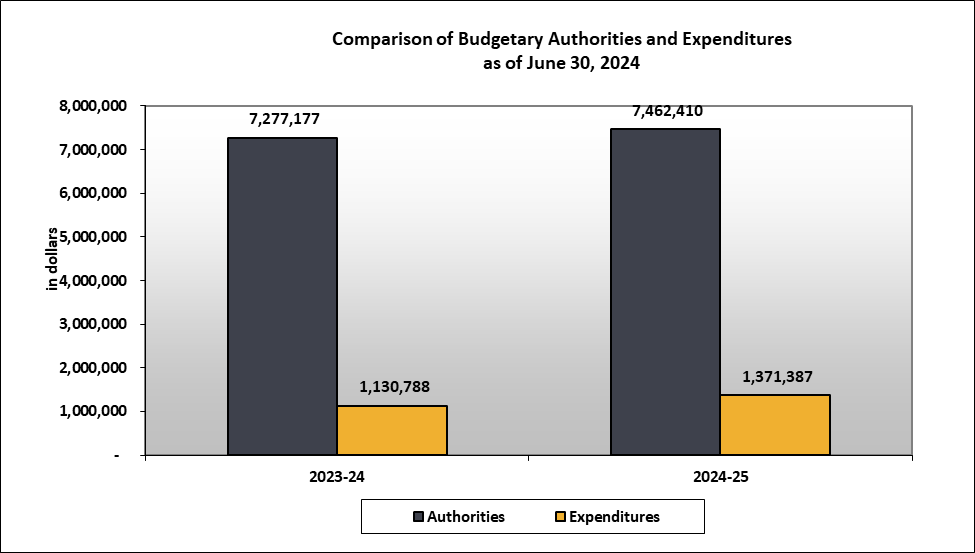

Vote 1 - Program expenditures | 6,734,211 | 1,189,337 | 1,189,337 |

Statutory authorities -Employee benefit plans | 728,199 | 182,050 | 182,050 |

Total Authorities | 7,462,410 | 1,371,387 | 1,371,387 |

| Fiscal Year 2023-24 | ||

| Total available for use for the year ending March 31, 2024 | Used during the quarter ended June 30, 2023 | Year to date used at quarter-end |

Vote 1 - Program expenditures | 6,667,400 | 1,027,933 | 1,027,933 |

Statutory authorities -Employee benefit plans | 609,777 | 102,855 | 102,855 |

Total Authorities | 7,277,177 | 1,130,788 | 1,130,788 |

By Standard Objects (SO)

| Fiscal Year 2024-25 | ||

| Planned expenditures for the year ending March 31, 2025 | Expended during the quarter ended June 30, 2024 | Year to date used at quarter-end |

Gross Expenditures: |

|

|

|

Personnel | 6,005,003 | 1,290,642 | 1,290,642 |

Transportation and communications | 350,000 | 58,997 | 58,997 |

Information | 200,000 | 60 | 60 |

Professional and special services | 500,000 | 18,212 | 18,212 |

Rentals | 20,000 | 1,259 | 1,259 |

Repair and maintenance | 50,000 | - | - |

Utilities, material and supplies | 277,407 | 437 | 437 |

Acquisition of land, buildings and works | - | - | - |

Acquisition of machinery and equipment | 50,000 | - | - |

Transfer payments | - | - | - |

Public debt charges | - | - | - |

Other subsidies and payments | 10,000 | 1,780 | 1,780 |

Total budgetary expenditures | 7,462,410 | 1,371,387 | 1,371,387 |

| Fiscal Year 2023-24 | ||

| Planned expenditures for the year ending March 31, 2024 | Expended during the quarter ended June 30, 2023 | Year to date used at quarter-end |

Gross Expenditures: |

|

|

|

Personnel | 5,935,610 | 1,071,498 | 1,071,498 |

Transportation and communications | 210,000 | 27,434 | 27,434 |

Information | 95,700 | 52 | 52 |

Professional and special services | 799,967 | 20,285 | 20,285 |

Rentals | 30,000 | 1,754 | 1,754 |

Repair and maintenance | 80,000 | - | - |

Utilities, material and supplies | 125,900 | 2,187 | 2,187 |

Acquisition of land, buildings and works | - | - | - |

Acquisition of machinery and equipment | - | 5,740 | 5,740 |

Transfer payments | - | - | - |

Public debt charges | - | - | - |

Other subsidies and payments | - | 1,838 | 1,838 |

Total budgetary expenditures | 7,277,177 | 1,130,788 | 1,130,788 |